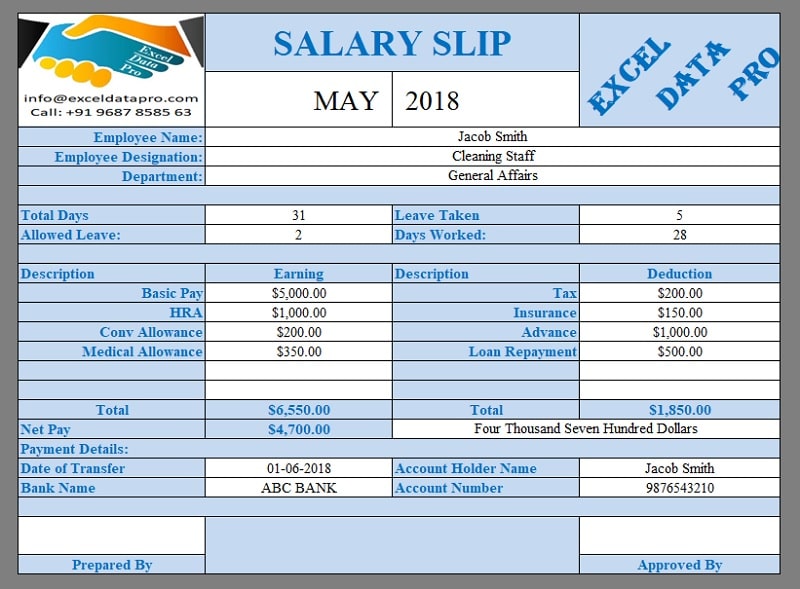

There are some deductions like tax, provident fund, insurance, etc. Consequently, the basic wage and the total allowances are summed up to calculate the gross salary. For example, the allowances are the house rent allowance, transport allowance, flexible benefits plan, etc. In this portion, we calculate the allowances distinctively for each employee. Besides, It contains the information about which deductions are cut from the salary and how much of the salary. Like which allowances the company provides and how much. Here, the salary structure is also declared. This component is comprised of the employee database which means the employee’s name and their basic salary. You can discretize the salary sheet in mainly four components. Upon these calculations, gross salary and net payable salary are calculated and recorded.

The basic wage of an employee, extra allowances, and deductions are recorded here. A salary sheet is a report where the net payable amount as salary to an employee is recorded.

0 kommentar(er)

0 kommentar(er)